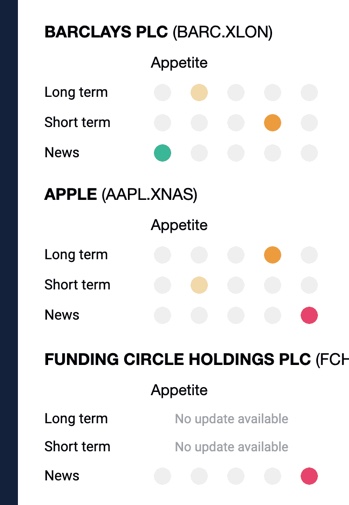

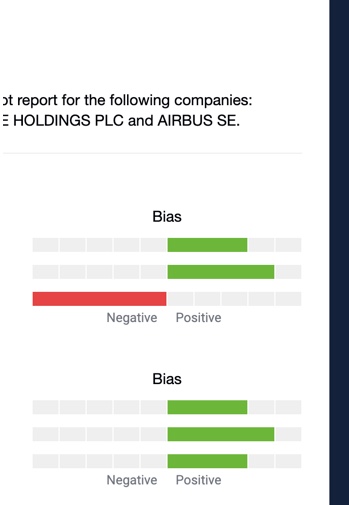

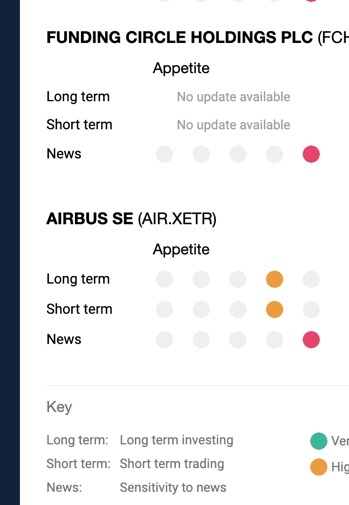

Important: Both Appetite and Bias reflect Irithmics’ AI’s assessment of the behaviour of populations of institutional investors. Like all populations, there will be a distribution of behaviours and it would be incorrect to interpret these data as describing the views or behaviour of all investors, or the market as whole. Our newsletters (including this snapshot report) are provided for general information only. It is not intended to amount to advice on which you should rely. Please read our terms and conditions.

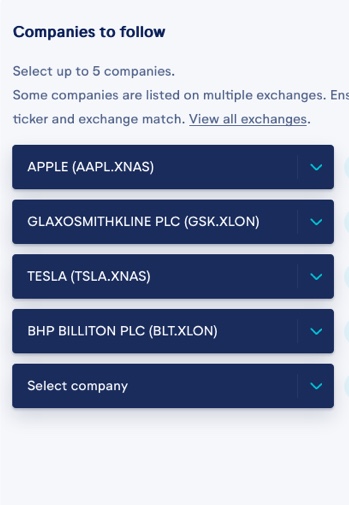

Snapshot Reports

The Company Snapshot Report allows you to receive personalised newsletters containing Irithmics’ award-winning AI assessments of publicly listed companies across global equity markets.