The Social Side of Capital

Inferring Connections Between Portfolios

By Grant Fuller

When AI focuses on the boardroom

In capital markets information shapes how institutional investors decide and choose to allocate and reallocate portfolio capital and risk.

Information is different from data. While the latter is reported and disclosed, collected and auditable, the former arises from the analysis, interpretation and contextualisation of data, and is often private and unobservable.

Advances in data science and artificial intelligence algorithms make it possible to recognise and classify subtle patterns in how institutional investors’ capital allocation decisions and choices are shaped by information - their private and unobservable analysis, interpretation and contextualisation of public data.

Buyside portfolio and risk managers use Irithmics as it provides them with a quantitative measure of how other independent market participants evaluate opportunity and risk (i.e. how others are allocating capital). This process helps shape their own views, strategies and risk management.

Activist shareholders, short sellers and social movement campaigners seek to proactively leverage Irithmics information, identifying which information is both salient to investors’ decisions and will advance the legitimacy of their agenda. In this case, the insights they develop help shape their campaigns, strategies and influence with a target’s shareholder register.

Engaging with these two communities (the buyside and activists) has enabled us to refine our analytics and use cases for these domains.

One of these refinements extends ideas discussed in a 2020 Fortune article which looked at how Irithmics applied AI to activism and shareholder dynamics. We call this ‘AI-mediated investor messaging’ (AIIM).

In practice, AIIM recognises and classifies how analysis, interpretation and contextualisation (information) shapes the allocations and reallocations of institutional portfolio capital and risk. While some information may strengthen and reinforce certain allocation (or reallocation) choices, other information may weaken and erode those decisions. Consequently, AIIM makes it possible for an agent (e.g. an activist, a short-seller, or corporate investor relations) to provide relevant salient information to enable investors to make better informed decisions and choices around their allocation of portfolio capital - maybe that’s why AIIM has also been described as “weaponising the share register”.

Over the past year, AIIM has been successfully prototyped with a number of activist organisations. Rather than campaigns and challenges which fail to capture to attention (and influence investors’ allocation choices), AIIM has enabled activists to delivery targeted, laser-guided analysis, interpretation and contextualisation, helping investors make better informed decisions.

What does this look like in practice? Here’s an example.

In late October 2022, Patrick Temple-Webb published an article in the FT: ‘Activist board battles to get more personal’. The article notes “activism is perking up” and describes how recent SEC rule changes “significantly lowers the barrier to entry for activists”.

The rule in question - the so-called “universal proxy” - is said to have “handed activists a new tool that companies fought for years to keep out of shareholders’ reach”. More specifically, this provides shareholders (including activists) additional flexibility to vote in favour of directors they like (and against directors they don’t). Consequently, the FT observes many corporates are engaged in an exercise to evaluate underperforming board members.

When AIIM is applied to a target, you discover how exposed and vulnerable corporates, their executive management and boards are to activist investors, short sellers and social movement campaigns which aim to leverage and influence shareholder support.

This vulnerability can be quantified (and hence measured and monitored) in terms of the gap between the most effective use of information to support and reinforce legitimacy and influence with shareholders, and the most effective use of information to weaken and erode legitimacy and influence.

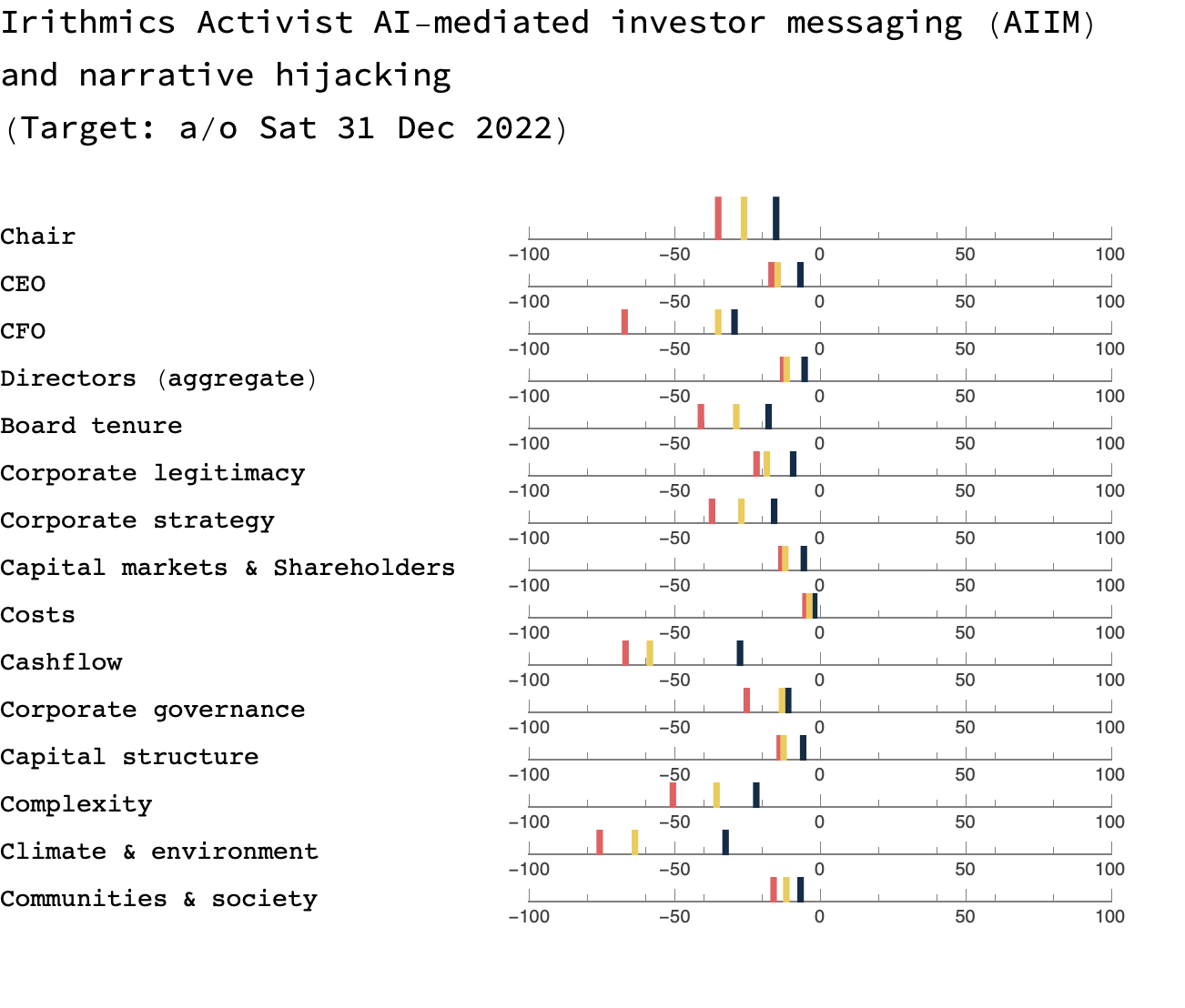

The chart below shows AIIM estimates for how information can strengthen and reinforce legitimacy and shareholder support (the blue lines) for different executive components (top panel) or narrative thematics (bottom panel). The chart also shows AIIM estimates for how information can weaken and erode support (the red lines). The blue line can be thought of as AIIM’s estimate of the ‘best case’ scenario of the impact information can have, while the red line is the ‘worst case’. The wider the gap between blue and red estimates, the greater the vulnerability the company (or its executives) are to having the narrative hijacked by external actors with a directional interest.

The yellow line is AIIM’s estimate of the present situation (i.e. how information is currently shaping legitimacy and shareholder support).

Generally, corporates would seek to avoid narrative hijacking and focus shareholder attention towards the blue end. In this situation markets consider information not only salient to investors’ allocation decisions and choices but also supportive of the company and its agents (management, board etc). Corporates, their executive management and investor relations would attempt to move the yellow line (the present) closer to the blue line (the best case).

In contrast, activists seek to focus shareholder attention towards the red end, widen the gap and hijack the narrative. In this case although information is equally salient to investors’ decisions, it is often contrary to the corporate’s investor relations agenda. Activists attempt to move the yellow line (the present) closer to the red line, and negatively influence the legitimacy or management or the company – supporting their case of change. This tactic is commonly observed when activist shareholders criticise management, short-sellers provide contrarian research, and social movement activists challenge the acceptability of certain activities.

Irithmics information quantifies and visualises this process and allows actors on both sides to optimise their strategy. The chart clearly shows how either side can strengthen their respective case, and weaken the other party’s.

Maybe this is what the FT meant by activist battles becoming “more personal”, or why Fortune titled their article “Click here to oust the board”.

It is critically important that corporates, their investor relations and strategic communications advisors are cognisant of this gap, monitor and manage its evolution.

If they don’t, someone else will.

Have any thoughts about this post? We’d love to hear them. Drop us a note.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.