The Social Side of Capital

Inferring Connections Between Portfolios

By Grant Fuller

How AI is reshaping investor engagement, and providing powerful insights into the corporate narrative.

The Covid-19 pandemic has brought economic, political and social disruption. Companies across the globe have had to make difficult decisions on staff redundancies, state assistance, investor dividends and executive compensation. Yesterday IAG announced a decision to award outgoing CEO Willie Walsh a bonus of more than £800,000. The decision attracted considerable criticism from influential shareholder proxy services firm ISS, which urged shareholders to vote against the remuneration plan they considered inappropriate.

Putting aside the specific details of IAG’s decision, the announcement serves as a helpful case study to introduce our series of blogs looking at Irithmics’ AI and some applications of our technology.

Executive compensation has long been a subject of contention between companies and their stakeholders. Increasingly institutional investors are voicing their disapproval over executive remuneration and rejecting pay deals. The subject is difficult to objectively quantify, partly due to its contextual nature and partly because of its close association with organisational legitimacy.

Legitimacy -- “a generalized perception or assumption that the actions of an entity are desirable, proper, appropriate within some socially constructed system of norms, values, beliefs, and definitions”1 -- is important for gaining and maintaining stakeholder support2. Legitimacy is key to organisational success3 and survival4 as is the support and resources provided by both shareholder and non-shareholder stakeholders which result from it.

Richard Benton and Jihae You have described how contextual themes (like executive compensation) are leveraged by activist investors to weaken management’s legitimacy, whilst at the same time, serve to reinforce their own cause with other shareholders5. Similarly, Brayden King and Sarah Soule demonstrated the impact that social movement protests (e.g. various environmental and social capital contextual themes) can have on shareholders, leading the scholars to conclude, “stakeholders who might be considered irrelevant under normal circumstances gain leverage over valuable resources (the market capital of the firm)6.

Traditionally, organisations have curated and managed legitimacy though communication and the corporate narrative7. The richness of voluntary and regulatory disclosures in annual reports has been shown to have a positive effect of an organisation’s legitimacy8 with corporates disclosing and reporting increasing amounts of material information in efforts to secure, strengthen and reinforce their legitimacy with shareholder and non-shareholder stakeholders9.

This series of blogs will look at how artificial intelligence (AI) is enhancing the understanding the way contextual themes affect organisational legitimacy and specifically their effect on institutional shareholders. The AI and analysis discussed in this series will not attempt to predict stock prices, or predict whether investors will buy or sell, or predict how shareholders will vote.

Instead, the series will consider how AI in being used to help corporates, their public and investor relations advisors, activist investors and non-shareholder activists (e.g. environmental campaigners) answer questions like:

“How might institutional investors be influenced by …?” or

“How might legitimacy be systematically strengthened [or weakened]?”

To help illustrate this, let’s return to IAG and ask “How might institutional investors be influenced by IAG’s executive compensation announcement?”

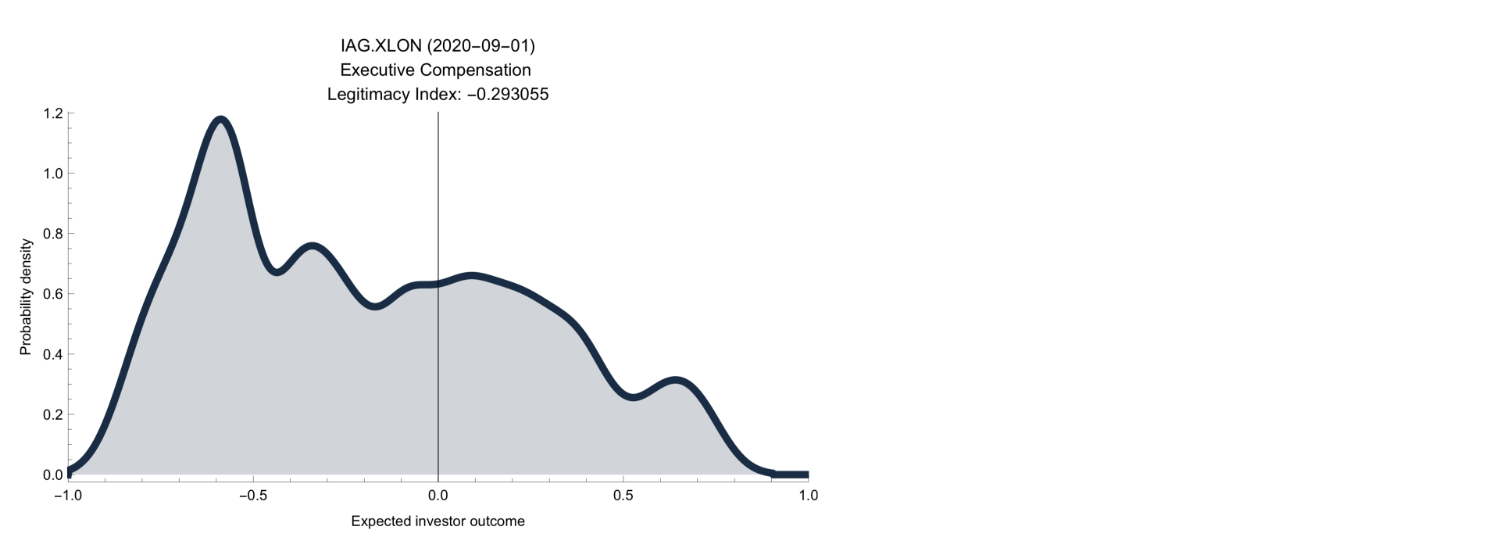

Here’s Irithmics’ AI assessment of how the contextual theme “executive compensation” affects IAG’s organisational legitimacy and specifically the effect on institutional investors.

We’ll get into more detail throughout the series, but as a preview we can see our AI models don’t reveal a single clear “for” or “against” (binary) answer. Instead the AI shows the distribution of possible outcomes with some outcomes being more likely than others. The outcomes (we call these “expected behavior”) are encoded as real numbers from -1 (extremely negative, antagonistic or bearish) to +1 (extremely positive, supportive or bullish). The chart is showing the “probability” of different expected behavior outcomes (from -1 to +1).

Using AI to understand the influence “executive compensation” is likely to have on IAG’s institutional investors shows a predominately negative assessment – in fact, negative outcomes account for 64% of the AI’s assessment, and 31.6% account for a significantly strong negative assessment of investor expected behavior.

This raises an interesting question: could this perception of IAG's investors be managed or changed, and if so, how? We believe it can, and developed Irithmics’ AI to better understand the impact news, data or information has on institutional investors, providing corporates with a powerful tool to help manage their narrative, manage market expectations and build stronger, healthier relationships with investors.

In subsequent blog posts, we will explore this in more detail. We’ll take a closer look at:

In the meantime, if you’d like to know more about Irithmics and how our technology evaluates the impact of different contextual themes on institutional investors, please get in touch.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.