The Social Side of Capital

Inferring Connections Between Portfolios

By Grant Fuller

Detecting and evaluating the impact of disrupting institutional investors

There has been much news recently about the losses inflicted on major banks associated with Archegos Capital. One such report is the $4.7bn losses incurred by Swiss investment bank, Credit Suisse.

Corporates, their executive management, investor relations and journalists are often keen to understand the significance of exogenous events on the decisions and behaviour of investors. The sharp 20% drop in Credit Suisse’s stock price towards the end of March revealed that investors reacted quickly, reallocating portfolio capital and risk away from the bank. However, other than observing magnitude, the significance and gravity of investors’ decisions cannot be not readily observed from just the stock price. To better inform and shape their understanding of market dynamics, corporates, their advisors and journalists regularly interview market participants, curating opinions of events.

Irithmics adopts a different approach: rather than interviewing and asking individual investors we observe their behaviour using artificial intelligence (AI) and machine learning to dissect and scrutinise portfolios, holdings and risk, letting the actions of market participants inform us of their views and expectations.

Our AI technology recognises and classifies patterns in the behaviours of institutional investors, enabling us to explain and anticipate their reactions and market activity. The patterns Irithmics’ AI has learnt to recognise relate to how institutional investment strategies collectively influence the allocation and reallocation of portfolio capital and risk in response to changes in market environments. As a result, the patterns and relationships revealed by Irithmics’ AI can model and describe isomorphic features of institutional investment strategies.

Isomorphism arises as organisational structures and processes (in this case investment strategies) become increasingly similar. Consequently, we might expect similar institutional investors and their investment strategies to respond in similar ways under similar constraints and conditions. By recognising, measuring and monitoring the prevalence of investment strategy isomorphism, it become possible to anticipate aspects of the collective impact on markets - the supply and demand pressure.

We can use this to investigate the significance the news of the losses had on Credit Suisse’s investors, and how disruptive it was to their views, expectations and capital allocations.

Anticipating similar, collective capital allocation and reallocations behaviours of institutional investment strategies provide an understanding of where supply or demand for a company’s stock might be amplified (or supressed) by the behaviour of other market participants. This enables Irithmics to estimate where the collective allocation of capital will increase demand for a stock, or the collective reallocation of capital will increase supply.

In many instances, the impact of investment strategy isomorphism is significant. It is important to understand that Irithmics’ AI is not describing, forecasting or predicting the stock price, but rather is anticipating how collective capital allocations and reallocations within institutional portfolios are likely to affect the supply and demand for the stock. The ‘pressure’ this creates (the supply and demand pressure) affects market price formation, volatility, liquidity and dynamics. Many of these effects can be subsequently observed in market activity.

When investors are presented with news, new data or contextualised information, they often respond by adjusting their views, expectations and subsequently, their allocation of portfolio capital and risk. Observing investors’ reactions to news regarding the losses of Credit Suisse through this lens reveals more about the significance of the impact and disruption on investors, and provides some warnings of future, potentially influential milestones.

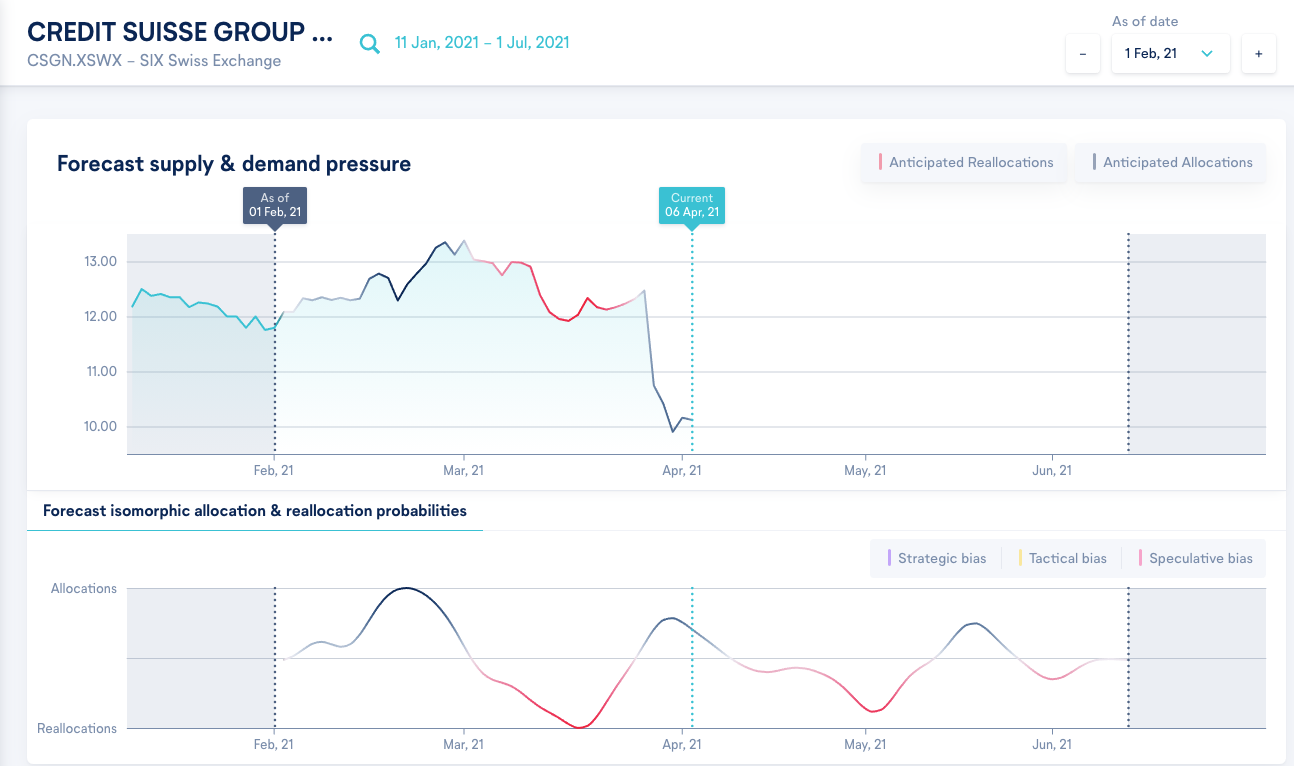

Figure 1 shows Irithmics’ AI supply and demand pressure forecast analysis for Credit Suisse. The bottom portion of the chart, “Forecast isomorphic allocation & reallocation probabilities”, is the output generated by our AI on 1 Feb 2021 (i.e. before any of the subsequent stock prices, or news of the losses, were observed in the market).

Figure 1 shows our AI anticipating increased pressure from institutional allocations throughout Feb, and the subsequently observed stock price over this period supports this. Our AI also anticipated an increase in supply pressure for early March (again, this is reflected in subsequent market observable price action). However, the anticipated allocations towards the end of March has been disrupted and eroded, reflected by the 20% drop in price on news of Archegos related losses. It would be reasonable to conclude that the news, rather than a simple correction, materially challenged views and expectations, disrupting investors’ capital allocation decisions in relation to Credit Suisse.

It will be interesting to monitor Credit Suisse and observe how quickly investors return to ‘normal’ allocation behaviours. Of particular interest is whether the collective reallocations anticipated for April and early May further compound the situation. Time will tell.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.