The Social Side of Capital

Inferring Connections Between Portfolios

By Irithmics

Irithmics' AI data enhances market commentators analysis of BP

The Armchair Trader has cited Irithmics’ data on BP in a recent article, “Institutional investors bullish on BP shares over short term – new data”, which refers to a number of pieces of Irithmics data.

The first reference is to Irithmics’ AI assessment of shorter-term tactical views of institutional investors towards BP. These shorter-term tactical views, while aligned with their strategic cousins, are typically associated with pricing anomalies and localised, discrete portfolio adjustments (e.g. in response to portfolio risk or liquidity considerations).

Irithmics’ AI also considers how ‘influential’ views are in shaping allocation decisions. As The Armchair Trader mentions, Irithmics’ AI considers shorter-term tactical views to have a 'High' or ‘Very high’ influence over portfolio allocation decisions at this time.

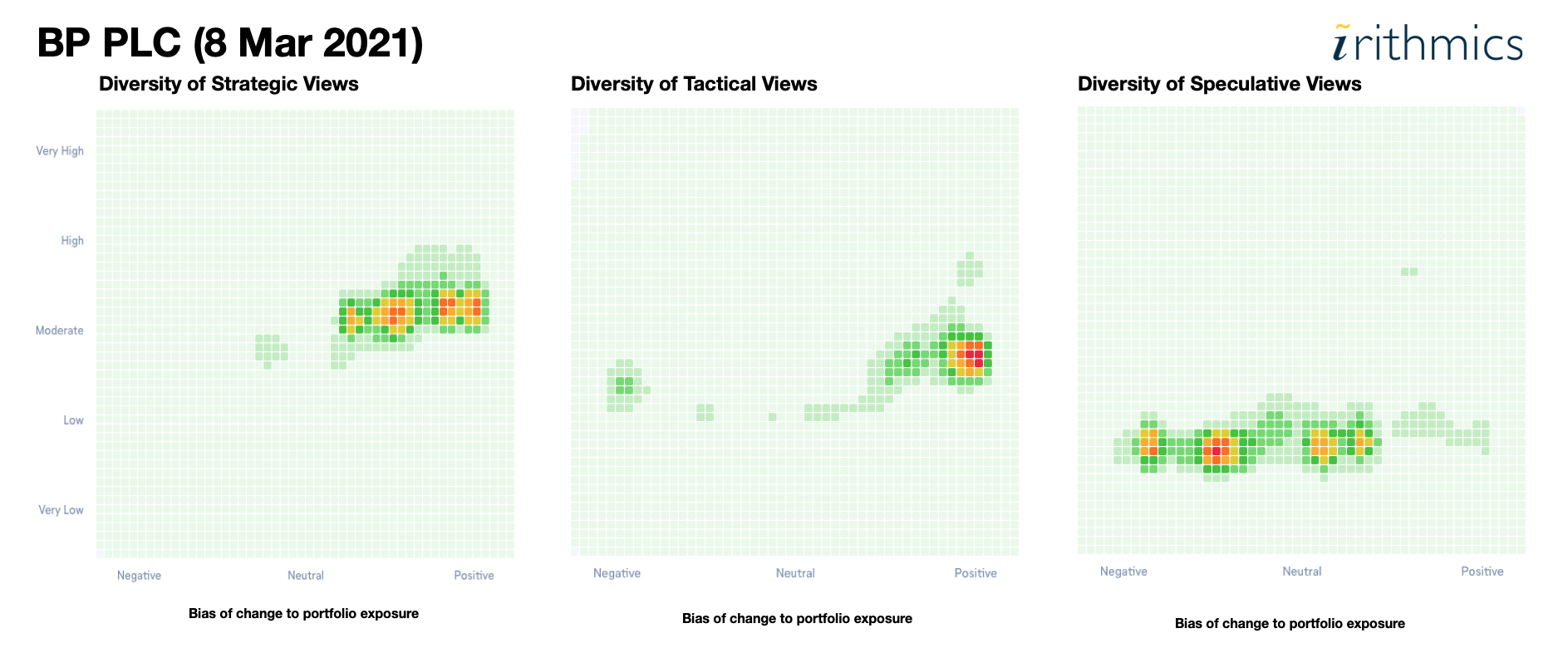

Figure 1 shows Irithmics’ AI assessment of the diversity of different views contributing to investors decisions to allocate or reallocate portfolio capital and risk to BP. The assessments show the diversity (or heterogeneity) of strategic, tactical and speculative views. Again, as mentioned by The Armchair Trader, Irithmics’ AI has recognised, and classified the distribution of strategic and tactical views as being mostly positive (the density of which is show by the clusters in orange and red).

Of particular note to The Armchair Trader article, is the small pocket of very positive and highly significant cluster of tactical views emerging. These can clearly be seen in the top-right portion of the 'Diversity of Tactical Views' section of Figure 1.

Taken in isolation, these data are interesting and, as The Armchair Trader article demonstrates, add colour to understanding market dynamics, providing additional insight into institutional allocations.

The value of Irithmics’ AI to buy-side and sell-side analysts is self-evident. “Successful investing”, according to renowned economist John Maynard Keynes, “is anticipating the anticipations of others”, and Irithmics’ AI assists these firms do just that, anticipate how other market participants view different securities.

Increasingly, corporates are using these analytics and data to fine tune and direct their investor relations activities, targeting these localised clusters of views, strengthening and reinforcing their corporate narrative and increasing the effectiveness of investor engagement and messaging. Modulating market sensitivities though the timely intervention of investor relations, providing context, explanation and narrative to data.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.