The Social Side of Capital

Inferring Connections Between Portfolios

By Grant Fuller

How Irithmics AI reveals data influential to investors’ decisions

This article will look at the widely reported friction between Toshiba and shareholders Effissimo and Farallon.

Investors are presented with new data every day. Their understanding, research and analysis of this data is often kept private and not disclosed publicly because investors believe their research and analysis provides them with insight which is not generally shared amongst other investors – a competitive information advantage. This difference in information (analysis derived from readily available and disclosed public data) results in an information asymmetry, leading investors to hold different views, opinions or conclusions based on the same underlying data. These views ultimately inform and shape the allocation of capital and risk, affecting portfolios and their performance.

Irithmics AI learns and recognises features and relationships in how institutional investors’ allocation of capital is influenced by different market environments, investment strategies and data. Using AI to recognise how data is influencing institutional investors allocation decisions provides several benefits:

Reading beyond the headlines, the issue its shareholders have presented Toshiba is one of legitimacy: the “generalised perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs, and definitions.” The actions taken by shareholders demonstrate that they do not believe Toshiba’s actions are “desirable, proper, or appropriate”.

In bringing the matter to an EGM, the shareholders are seeking the opportunity to present other shareholders with data supporting and evidencing their concerns. Ultimately, they are seeking to erode management’s legitimacy, to leverage the support of other shareholders and to influence the decisions of Toshiba. In contrast, Toshiba’s management will attempt to strengthen their legitimacy, but weaken the legitimacy of shareholder dissent.

For both sides, it is important to maximise the efficacy, and the attention other shareholders provide, to the data they present to support their argument, thereby enabling other investors to make informed decisions.

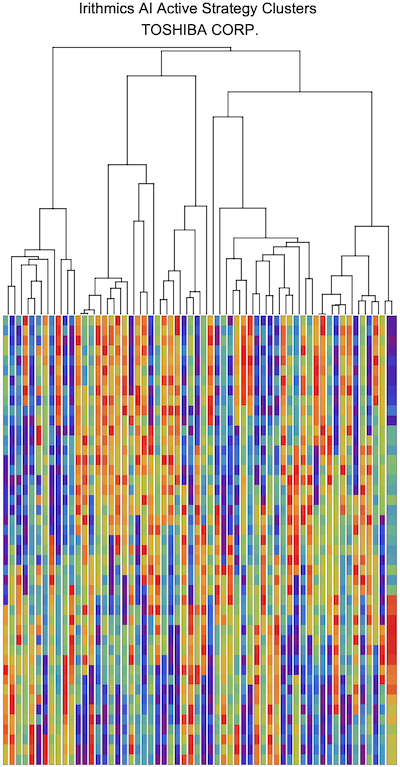

To understand the effect of how different data is likely to affect different institutional investors’ views of Toshiba, Irithmics AI first evaluates a range of different institutional investment strategies which are consistent with investors’ portfolios and performance. Figure 1 shows the 59 distinct families of strategies recognised by Irithmics AI which can be used to explain investors’ views towards Toshiba. Importantly, the hierarchy of these strategy families (how they are related to each other) can also be seen in Figure 1.

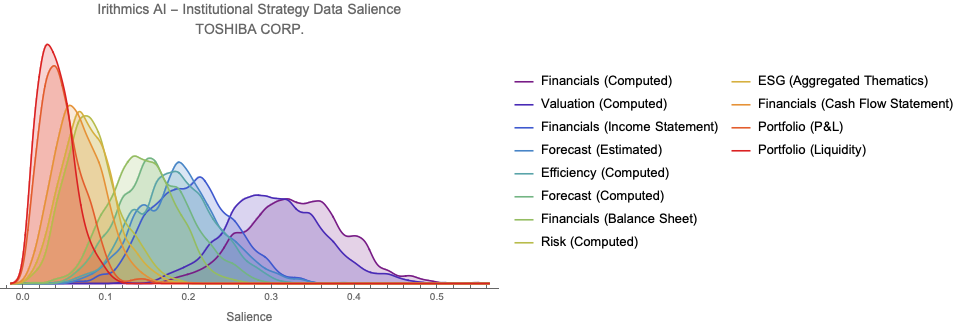

Different investment strategies react differently to different data. The extent to which an investor will increase or decrease allocation of capital to Toshiba will depend on their portfolio, their strategy and the relevance of the data. While not possible to understand the impact specifically relevant data will have on specific investors or funds, it is possible to describe the relationship for large populations of investors. Figure 2 illustrates the data salience (the importance and relevance of particular data) to the functioning of a strategy or the development of investors’ views and expectations in relation to Toshiba. While financial and valuation-related data have a significant effect the allocation of capital, they are not the only type of data which influence investors’ decisions.

The relationship between institutional investment strategies and data salience provides a powerful tool to understand how Toshiba and the activist shareholders might adjust their arguments to strengthen their own legitimacy, and to weaken the legitimacy of the other party.

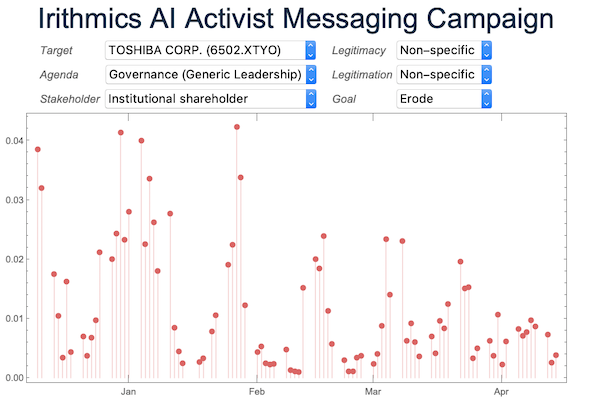

As Irithmics AI models the dynamics of longer-term strategic views, shorter-term tactical views and reactionary speculative views, it is able to estimate how data salience is likely to affect strategies over different time periods. Figure 3 shows how the activist shareholders might leverage the support of other shareholders using arguments which weaken Toshiba’s management’s legitimacy governance and leadership throughout January, February, March and early April 2021. This analysis demonstrates that arguments which weaken Toshiba’s legitimacy with regards to governance and leadership are more likely to resonate with shareholders towards the end of January, mid-February, early and late-March.

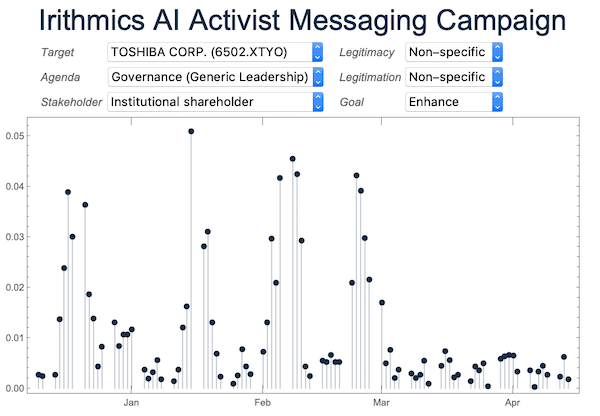

In contrast, arguments which strengthen Toshiba’s legitimacy with regards to governance and leadership are more likely to resonate with shareholders mid-January, early and late February (Figure 4). Interestingly, this analysis also shows shareholders are unlikely to be responsive to arguments which seek to strengthening Toshiba’s governance and leadership throughout March and early April.

Whatever the outcome of Toshiba’s EGM, we have demonstrated the ability of Irithmics AI to analyse the behaviour, strategies and allocations of institutional investors, recognising how they respond to different data and how those data can be used by corporates, activist shareholders and other stakeholders to more effectively leverage the support of investors.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.