The Social Side of Capital

Inferring Connections Between Portfolios

By Grant Fuller

Anticipating institutional allocations and market reaction to corporate earnings announcements

March is a notoriously busy month for corporates, investors and equity research analysts. Earnings season, and the promise of new data, sees market participants reviewing, scrutinising, revising and analysing reports, forecasts and estimates. Sometimes new data reinforces views, at other times views are challenged by financial results and a deeper analysis of the new data.

The past 12 months have been extraordinary: socially, politically and economically. This March, as earnings seasons begins, Irithmics is providing listed companies with analysis of our AI's assessment and forecasts of the supply and demand pressure created by institutional portfolios allocating and reallocating capital. In doing so, we hope that corporates, their executive management and investor relations are better placed to explain and anticipate market reactions to news, announcements and data – removing some of the surprises.

At its core, Irithmics’ AI learns to recognise and classify patterns in how institutional investors manage their portfolios and exposures towards different companies. Identifying these patterns allows Irithmics to describe and anticipate the allocation behaviour of investors. Three main components of Irithmics’ AI make this possible: firstly, a set of deep neural networks evaluate and model the views and expectations behind institutional portfolios and allocations; secondly, reinforcement learning models learn how investors’ views and behaviours combine to form viable investment strategies; and thirdly, agent based modelling and generative adversarial networks anticipates how investment strategies, views and markets interact, thereby affecting the allocation of capital and risk by institutional portfolios (we discussed this in a previous blog article). Observing the activity of institutional investors in this way provides an enhanced understanding of market behaviour and dynamics.

A total revenue of $47,64 billion on 31 December 2020 makes Pfizer is one of the world’s largest pharmaceutical companies and serves as an illustrative example of the type of insights the technology can discover about companies and their institutional investors.

With an earnings announcement on 2 Feb 2021 and forecasted revenue of $11.47 billion, Irithmics’ AI had already begun to recognise patterns in how institutional investors were modifying portfolios: specifically Irithmics’ AI had decoded and described the strategic, tactical and speculative views and expectations of investors.

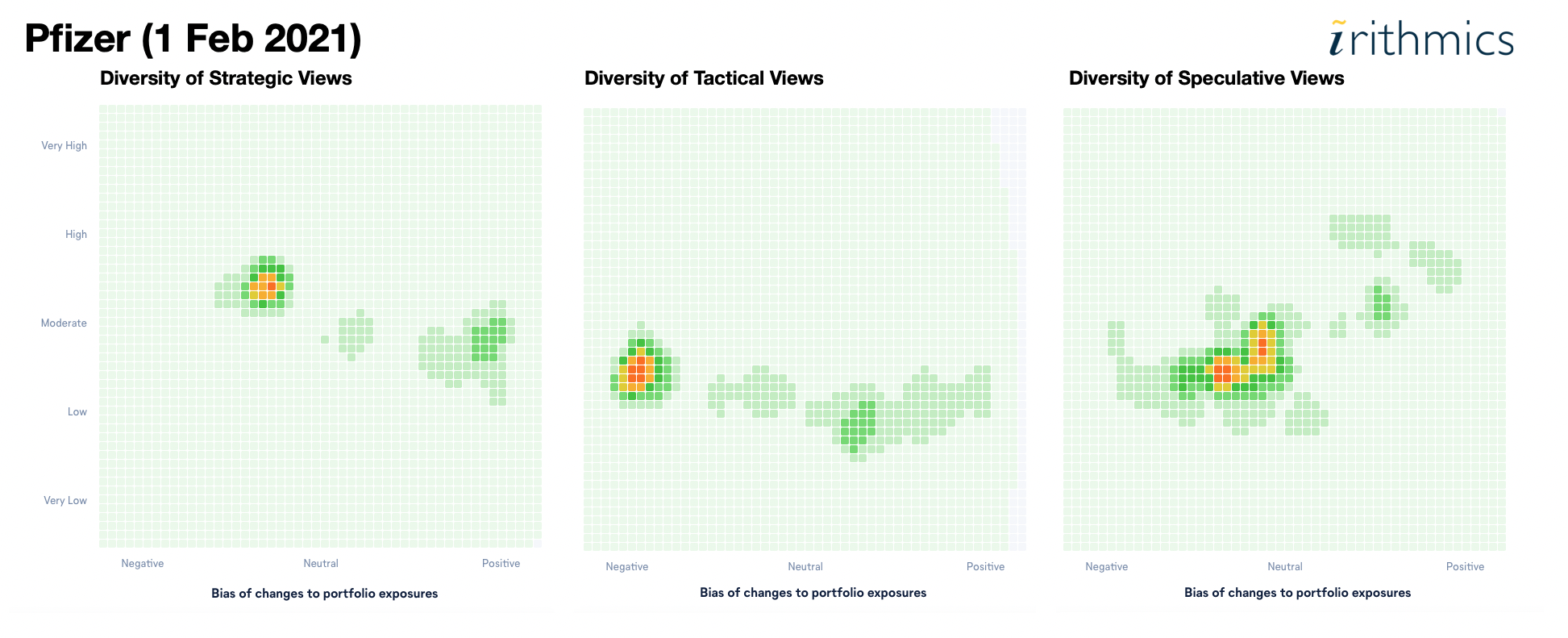

Figure 1 illustrates Irithmics’ AI assessment of the heterogeneity of views and beliefs held by investors towards Pfizer on 1 Feb 2021 (the day before the company’s earnings announcement). In particular, Figure 1 highlights the existence of discrete pockets, or clusters, of similar views. Of note to Pfizer, the clusters with greatest density (more red) are ascribed predominately negative outlooks. More positive views on the firm are less dense and, crucially, are considered to have lower conviction. The exception are speculative or opportunistic views: while the density of speculative views are also predominately negative, a number of higher conviction, more positive views have also been identified.

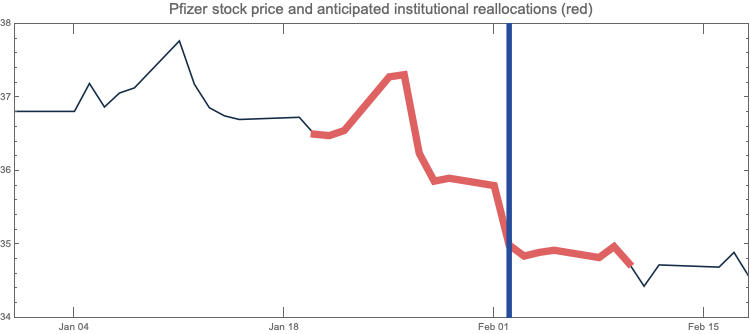

This assessment, and the subsequent market reaction to the company’s announcement on 2 Feb 2021, were not unexpected. On 31 Dec 2020, Irithmics’ agent based modelling and generative adversarial networks had identified how institutional investment strategies were likely to allocate and reallocate capital in relation to Pfizer. Figure 2 shows these agents and adversarial networks considered the period between 20 Jan 2021 and 12 Feb 2021 likely to witness increased portfolio reallocation of capital, leading to increased supply (and reduction in demand) of Pfizer stock.

The news that Pfizer’s earnings had exceeded analysts’ expectations ($11.68 billion versus analysts’ forecasts of $11.47 billion) was insufficient to modify or interrupt investors views and influence the reallocation of capital in portfolios.

While this analysis on a single company (Pfizer) is insightful and illustrative, exchanges, regulators and central banks are more concerned with the dynamics of entire markets.

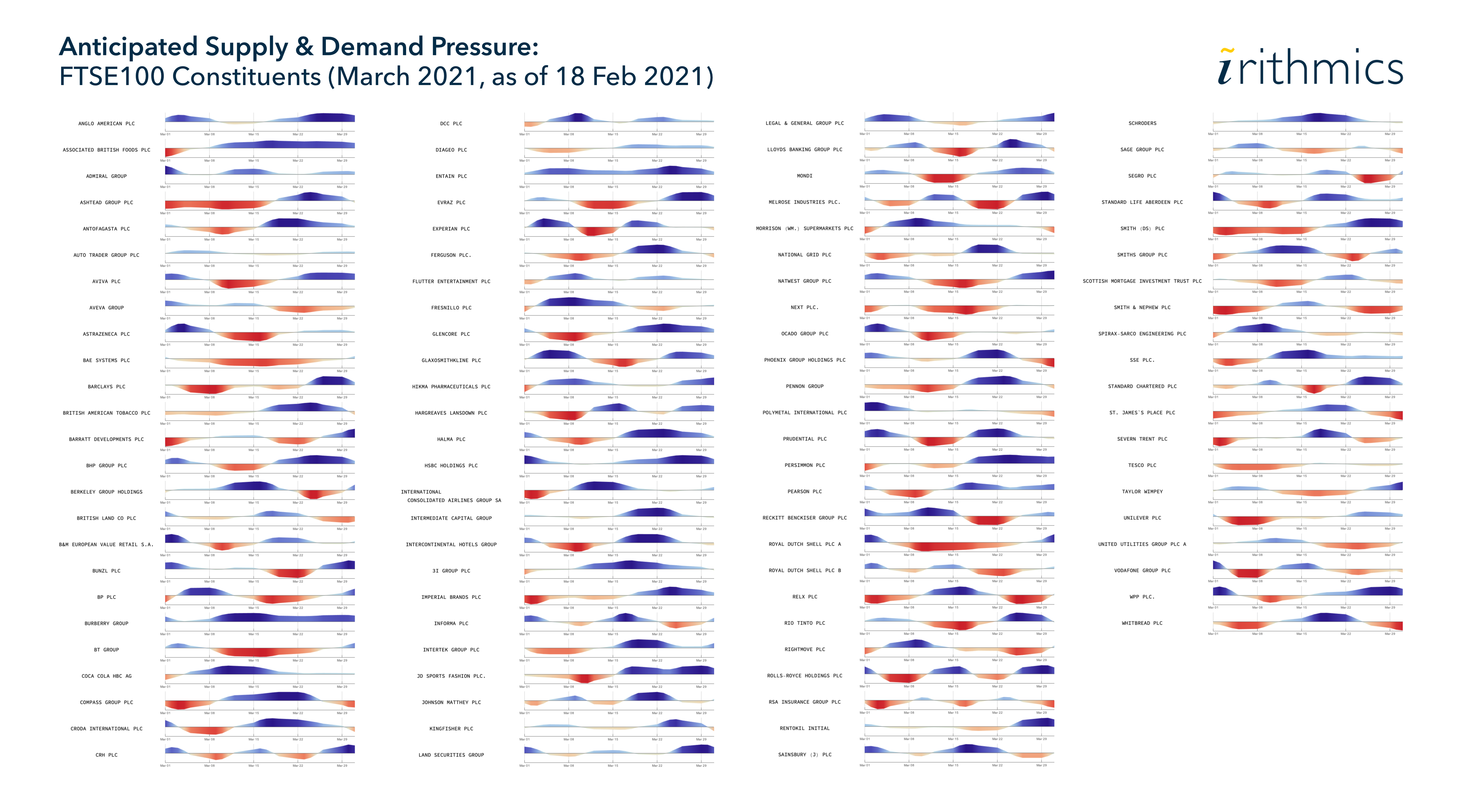

Figure 3 (generated as of 18 Feb 2021) shows Irithmics’ AI anticipation of institutional investors’ supply and demand pressure for FTSE 100 constituents* during March 2021. Every day, our AI revises its assessments and updates its anticipation based on new announcements and data, somewhat like a weather forecast. These updates allow issuers and asset managers to measure and monitor changes in how market participates are positioning themselves, and how views are evolving in response to market environments.

From a corporate’s perspective, understanding the diversity of institutional investors’ views and expectations, measuring and monitoring how they collectively allocate and reallocate capital and risk within their portfolios provides invaluable and actionable insights.

While (as in the case of Pfizer) these insights help explain market reaction to earnings announcements, they also provide corporates the data driven analysis to manage and curate investors’ views. Identifying the development and evolution of clusters of views (strategic, tactical and speculative) enables corporates to adapt their messaging and narrative to more effectively address investors’ opinions, beliefs and biases.

* some issuers are excluded because Irithmics’ AI doesn’t have sufficient data to classify the patterns of institutional behaviours it's trained to recognise.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.