The Social Side of Capital

Inferring Connections Between Portfolios

By Grant Fuller

Examining how ESG data can affect institutional capital allocations

In a previous article on our Irithmics Blog, we described how Irithmics AI exploits institutional investment strategy isomorphism to anticipate future allocations and reallocations of capital within portfolios. In this article we will examine the relationship between investment strategies and the data investors use to develop views which form the basis of their allocations of capital.

As an illustrative example, we will use recent news of shareholders pushing HSBC to reduce the loans and underwriting services offered to clients associated with carbon intensive projects and industries.

More specifically, we will consider how institutional investment strategies are decoded by deep neural networks which classify the data salient to their views, and ultimately allocation of capital.

It is common to describe markets (and investors) as being bullish or bearish, but such a simplification obscures the diversity and context of views which result from investors’ heterogenous experience, expertise, analysis and strategies.

Irithmics AI classifies views according to their context within strategies: strategic, tactical or speculative. Whilst it’s convenient to consider these as distinct contexts, in practice Irithmics AI recognises that views almost always have multiple contexts and fulfil multiple roles within portfolios.

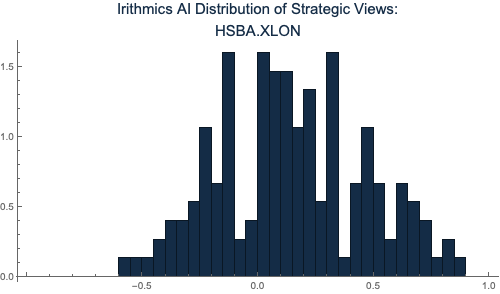

Figure 1 is an example of the diversity of views recognised by Irithmics AI (on Jan 11, 2021) in relation to HSBC (HSBA.XLON). It illustrates how the majority strategic views evaluated by the AI are likely to be favourable toward HSBC (more views aggregate in the positive tails of the distribution) and, on this particular date, are likely to result in allocation of capital and risk.

The investment strategies from which these views originate are equally diverse. Investment strategies are also dynamic, adjusting and adapting in response to evolving market environments.

The deep neural networks within Irithmics AI recognise patterns of investors’ allocation behaviour, classifying these according to its assessment of different investment strategies. Irithmics AI is not attempting to reverse engineer, replicate or clone individual investment strategies, nor is Irithmics AI seeking to develop, improve or rate investment strategies. Instead, Irithmics AI is attempting to quantify different facets of the collective behaviour of investment strategies and identify similarities in how different strategies function.

In the same way that similarities between living organisms allows biologists to classify life into different families based on form and function, investment strategy isomorphism allows Irithmics AI to classify strategies into families based on similarities in their views and the data which influences these views.

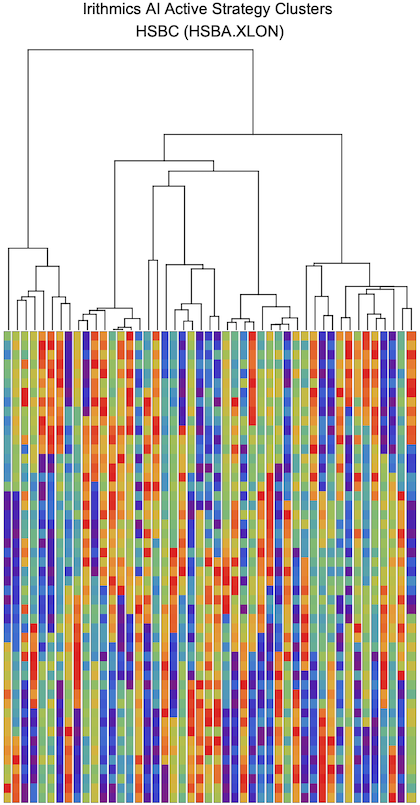

Figure 2 shows how Irithmics AI has classified the hierarchy of investment strategies towards HSBC, recognising 47 distinct families of strategies responsible for the views, and subsequently the allocation of capital to HSBC.

The importance and relevance of particular data to the functioning of a strategy or the development of investors’ views and expectations – which we refer to as data salience -- provides initial insight into the decision making processes of institutional capital allocation.

Irithmics AI classifies investment strategies according to the data which its deep neural networks have identified as being influential to the formation of views. Naturally, this raises the question: which data are salient to strategies and the allocations of capital?

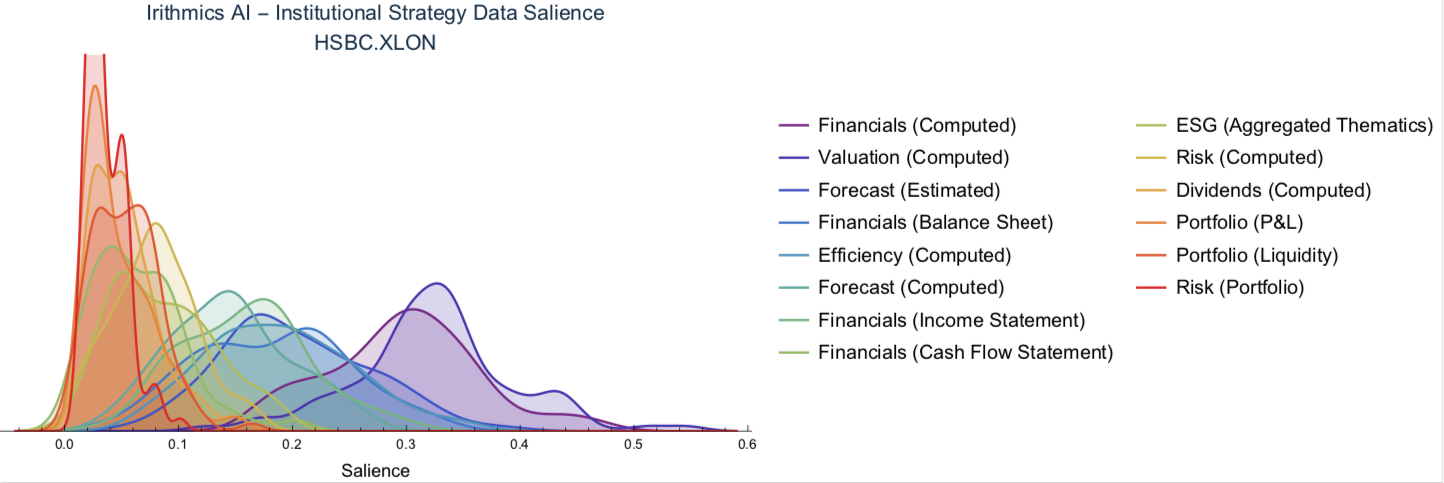

Figure 3 illustrates Irithmics AI’s assessment of the distributions of some of the different factors influencing institutional investment strategies.

Unsurprisingly, financial and valuation-centric data have significant contributions. This is universally true across all 16,000 listed companies analysed by Irithmics AI and largely reflects the nature of capital markets and institutional investors.

Of particular note to this article, is the significance of ESG related data. ESG themes do not appear to significantly influence investment strategies towards HSBC. However, this analysis would typically only consider ESG factors associated with HSBC itself, and not include impact of indirect downstream activities facilitated by HSBC, which is the basis of the reported shareholder pressure.

Generally, data relating to ESG themes lack immediacy of action (in terms of portfolio risk and P&L) and therefore do not have a significant role in the formation of speculative views, but do become more relevant to the formation of institutional tactical and strategic views.

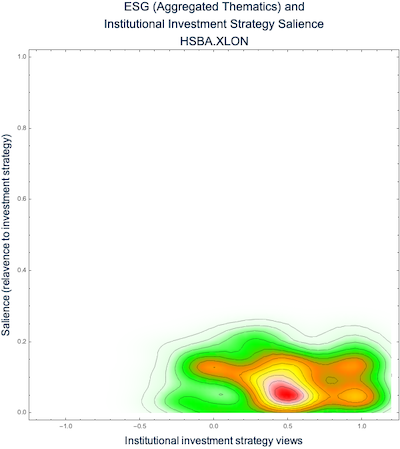

Irithmics AI’s assessment of the salience of ESG thematic data to the formation of tactical views towards HSBC (as of 11 Jan 2021) can be seen in Figure 4. Moreover, it illustrates the relatively low (but still significant) salience of ESG themes to the formation of tactical views – less than 15%.

Changing market environments cause investment strategies and data salience to adapt and evolve. Under different markets environments, different strategies find some data more relevant that others to identify new market opportunities or risks. Overtime the salience of data changes and investment strategies shift their focus to what is considered more important.

Social sciences have provided numerous models which help understand how information spreads through networks and dynamic systems. These models have been used to explain rumours and news contagion, market volatility and investor herding, market bubbles and crashes.

The addition of Irithmics AI extends these models and shows the relevance of different data to different strategies and their subsequent allocation of capital. Understanding the salience of data to the formation of investors’ views and allocation of capital provides an opportunity to present them with relevant and informative data.

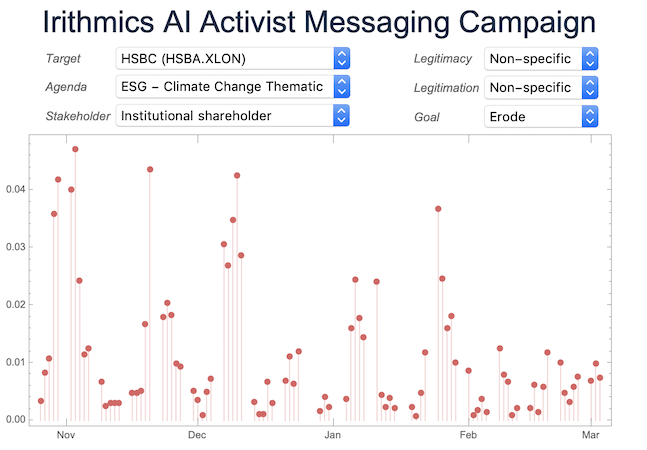

ESG climate change thematic data can be used to strengthen or erode the legitimacy of HSBC management from the perspective of institutional investors.

In Figure 5 we see that early and late January are likely to find institutional strategies increasingly sensitive to ESG climate change thematic data. This provides an opportunity to challenge, weaken or erode HSBC’s management legitimacy. Based on this assessment, the announcement of shareholders challenging HSBC’s exposure to fossil fuel industries was especially well timed to capture the attention of investors (Figure 5 also shows when shareholders are likely to be similarly more receptive throughout February and March).

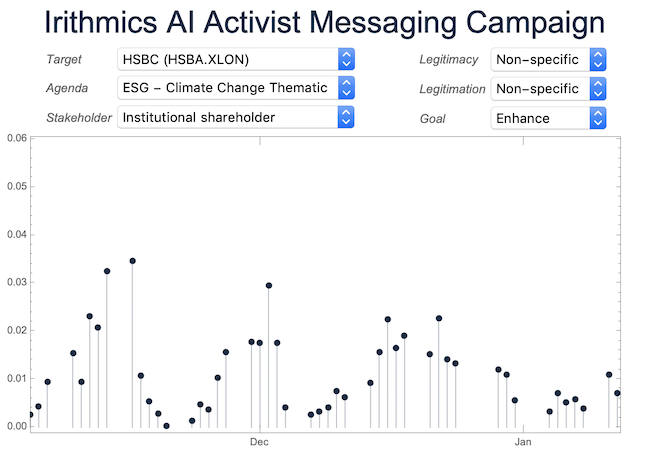

We can also seek to understand when shareholders are likely to be more receptive and supportive of management’s stance on ESG matters. Figure 6 demonstrates periods identified by Irithmics when the dynamics of institutional investment strategies, and their data salience make investors likely to be more receptive to data reinforcing or supporting management’s legitimacy and approach to ESG matters.

While the result of HSBC’s shareholder challenge will be decided at an AGM in April, Irithmics AI is generating the insights needed to help provide relevant data to investors at the relevant time to inform their views and allocation of capital decisions.

Using deep neural networks and reinforcement learning, Irithmics AI decodes and classifies institutional investment strategies according to the salience of data likely to contribute to investors’ views. The hierarchical classification of strategies highlights how data can influence the formation of institutional views and the allocation of capital, providing stakeholders and engaged investors the opportunity to address concerns relevant to shareholders at that time.

In their 2020 article, “Click here to oust the board— Inside the A.I. startup that’s transforming activist investing”, Fortune Magazine described the adoption of Irithmics AI technology and consulting by activist investors and activist short-sellers and declares Irithmics AI technology “could make virtually any investor an activist investor”. With many expecting a rise in shareholder and non-shareholder activist campaigns in 2021, Irithmics AI monitoring of institutional investment strategies and the information cascades provides actionable insight to those seeking to more effectively leverage the support and influence of shareholders.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.