The Social Side of Capital

Inferring Connections Between Portfolios

By Irithmics

The Armchair Trader published an article on 14th September referencing Irithmics AI-assessment of International Consolidated Airlines (LSE:IAG).

Irithmics uses AI to analyse and model the market behaviour, portfolios and strategies of institutional investors.

The Armchair Trader’s article looked at three aspects of our AI analysis:

The holdings within actively managed institutional portfolios reflect managers’ market outlooks, views and expectations (we refer to these collectively as “views”) of markets and individual companies. Views are used to understand investors’ opinions or beliefs about the financial performance (or other metrics) of companies, sectors or markets.

Collectively, views reflect aspects of the underlying strategies behind portfolios. Strategies influence how managers allocate capital and risk in their portfolios and how these are adjusted in response to changing markets.

Using AI to learn key features of institutional strategies can identify where exposures to particular companies are likely to be increased or decreased.

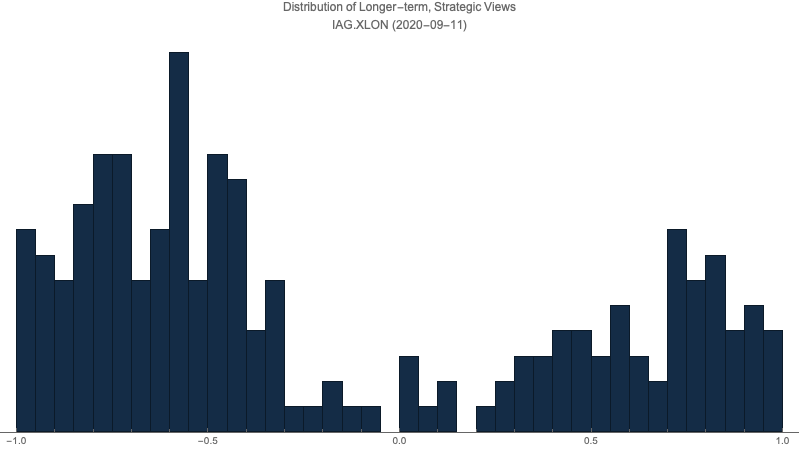

Here’s a chart of our AI’s assessment of longer-term, strategic views towards IAG on 11 Sept, 2020.

The chart shows the distribution of views which have been encoded as real numbers from -1 (extremely negative, antagonistic or bearish) to +1 (extremely positive, supportive or bullish). The distribution has been generated using deep neural networks which have been trained to identify how different views affect the allocation of capital within institutional portfolios.

Since views reflect investors opinions or beliefs, “positive” views on a company would be associated with portfolios having larger than expected exposures (compared to market neutral portfolios). This distribution of views shows the majority of views evaluated (63.9%) to be negative, suggesting investors’ preference to allocate capital elsewhere. Typically, this results in a reduction in appetite to buy stock or in an increase in selling as capital is reallocated. However, while a company’s share price is affected by the buying and selling of investors, there are many reasons why it would be incorrect to infer share price changes from this distribution.

This analysis is useful to understand how and why investors (or markets) are behaving the way they are. Corporates, investor relations advisors, brokers and asset managers use these data to better evaluate the views (and positioning) of market participants with respect to individual companies.

Markets do not hold a single homogenous view on a company, but as described above, there exists a distribution of views. This distribution of views is not static, but evolves and changes over time and there are many different reasons for this. Sometimes, there is a (“material”) market shift in the composition and structure of the views which make up the distribution. While the overall affect (positive or negative) might remain unchanged, the nature of the views themselves has changed.

Irithmics’ AI monitors the composition and structure of views for a particular company and identifies when this has changed. The alerts raised by the AI in relation to these changes are ex ante (i.e. they occur before evidence of them has been observed in the market). These alerts often (but not always) precede changes in market behaviour (e.g. volatility).

The Armchair Trader article singled out a number of dates flagged by our AI in relation to material changes in the structure of longer-term, strategic views. The dates flagged did correspond to changes in market behaviour. Most notably, the AI identified the nature of longer-term, strategic views had changed on 19 Feb 2020 which preceded a 69% drop in IAG’s share price as investors withdrew capital and evaluated their views and expectations.

Executive compensation has long been a subject of contention between companies and their stakeholders. Increasingly, institutional investors are voicing their disapproval over executive remuneration and rejecting pay deals. The subject is difficult to objectively quantify, partly due to its contextual nature, and partly because of its close association with organisational legitimacy.

“Contextual themes” like executive compensation can have an effect on investors’ allocation of capital. Irithmics’ AI uses natural language processing (NLP) to evaluate how different contextual themes (e.g. executive compensation) relate to the views of institutional investors.

The Armchair Trader article was referencing this blog we published on 2 Sept.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.