IR in the Age of AI

Opportunities and challenges for investor relations from artificial intelligence.

By Grant Fuller

How news propagates through financial networks affects the allocation of capital and risk in institutional portfolios.

As the world deals with the impact of the Covid-19 Coronavirus outbreak, a mounting worry for health authorities around the world is the rapid spread of unverified or even false information about the virus and its impact. On the 15th of February the BBC reported that a WHO official had warned at a meeting with the tech giants of Silicon Valley that “The spread of misinformation, and false information about the virus itself is spread faster than the virus, and it's got into more people's lives and infected more people than the actual virus itself". Rumours, opinions, beliefs and views can have serious consequences, and many companies and organisations around the world are searching for better ways to understand how they are created and how they propagate.

In 2014, researchers from the Engineering University of the Chinese People’s Armed Police Force published a paper titled: "A Rumor Spreading Model with Control Mechanism on Social Networks” [Wang, Y.-Q & Yang, X.-Y & Wang, Jing. (2014). Chinese Journal of Physics. 52. 816-829]. Using models similar to those used to understand the spread of infectious diseases, the researchers investigated the dynamics of rumour propagation through different types of networks and showed how (theoretically) the probabilities of rumour outbreaks can be decreased and the control of rumour transmission can be improved.

A rumour is an unsubstantiated or unverified information, which can be true or false and is persistent and pervasive in nature. Whilst rumours are distinct from gossip (unverified information restricted to people we know) or legend (unverified long-lasting and widespread stories that become part of a culture), they are very similar to beliefs, opinions and views in their ability to shape or alter the expectations, behaviour and actions of individuals and groups.

Since its very beginning, Irithmics has been concerned with measuring and describing expectations, views and opinions. Originally, these insights were related to public health and epidemiology, just like the models of Wang et al. and others used to understand the spread and control of rumour. Today, we use the models and algorithms we developed in order to understand and anticipate how news, information and investors’ views and expectations propagate through financial markets and networks.

Irithmics uses machine learning (ML) and artificial intelligence (AI) technologies to analyse how institutional investors build, manage and mitigate risk in their portfolios: helping to decode investors’ views and expectations (we will refer to these collectively as “views”). Irithmics’ AI also helps us to understand and explore how news, data and information shape and influence investors’ views.

The insights gained from our machine intelligence contain a range implications for corporates and their shareholders. Investor relations and corporate communications of listed companies now have a better way of understanding how news influences investors’ allocation of capital, how institutional portfolios are affected as investors absorb and make sense of news, how their views are adjusted and adapted, and how they best to attempt to mitigate risks and exposure. The insights also help asset managers and asset owners to understand and monitor the risk to their portfolio arising from endogenous news contagion across the market - the behaviour and reactions of other market participants.

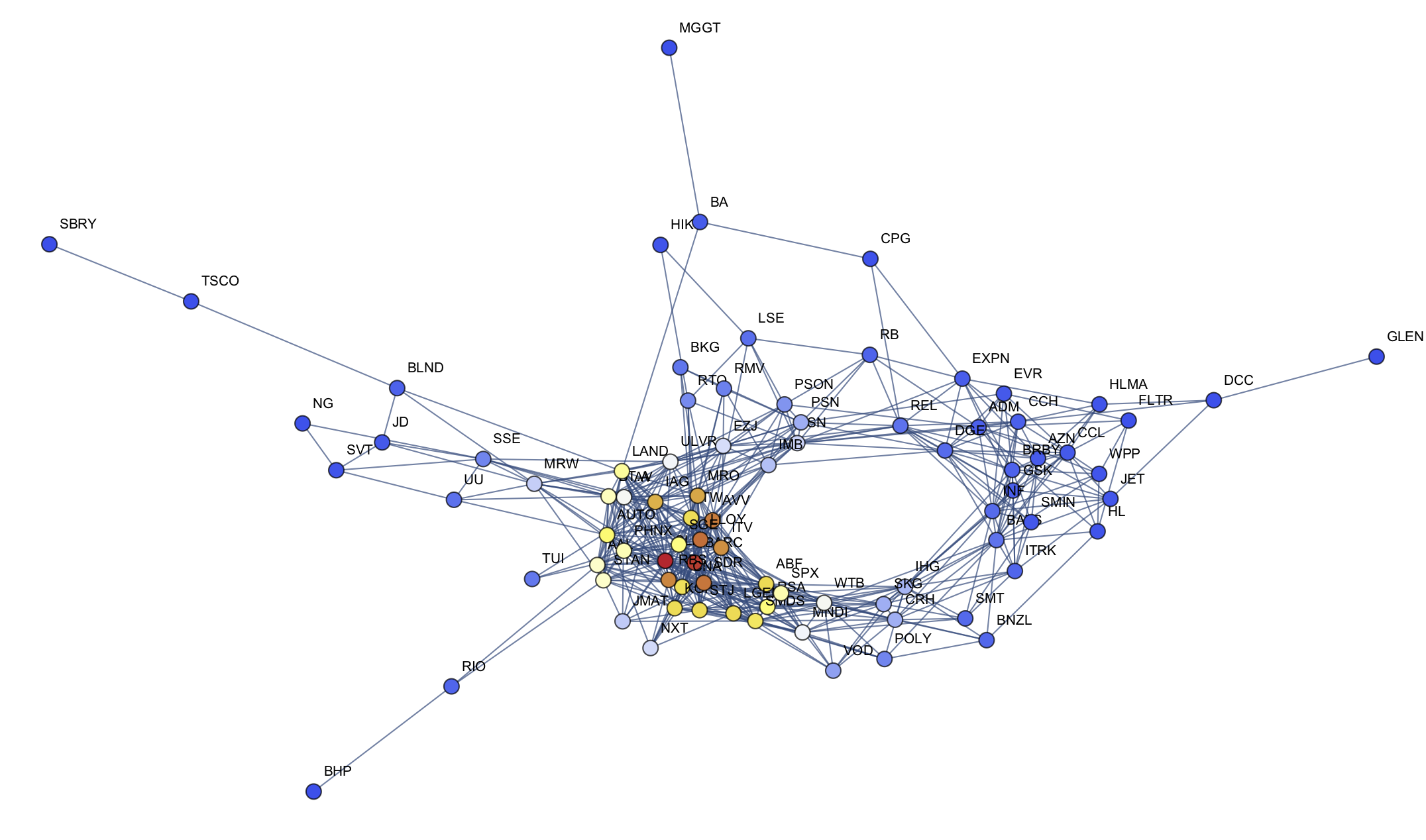

Here’s a small example which looks at FTSE100 firms on Friday, February 7, 2020.

The network in Figure 1 displays the nodes (FTSE100 firms) and edges (the lines between the nodes). The edges show that Irithmics’ AI has identified a relationship between news about one firm and its impact on investors’ beliefs of another firm. From this network, we are able to visualise how news about any one FTSE100 firm was likely to “ripple” and affect investors’ beliefs of any other FTSE100 firm on Friday, February 7, 2020.

Looking towards the dense centre of the network, the firms most likely to have a ripple effect on the portfolios of investors in the event of news contagion were the financial services firms Standard Life Aberdeen, Barclays, Lloyds, Schroders, Aviva and RBS. News or a change in investors’ beliefs about these firms is likely to impact the exposures and risk taken by investors towards other firms.

The five firms most likely to have their exposure in portfolios adjusted (either increased or decreased) as a result of investors reacting to news about Standard Life Aberdeen would be Schroders (SDR), Barclays (BARC), Melrose (MRO), Royal Bank of Scotland (RBS) and Phoenix Group (PHNX). In contrast, the five firms least likely to have their exposures adjusted would be Informa (INF), Prudential (PRU), Barratt Developments (BDEV), GlaxoSmithKline (GSK) and Hargreaves Lansdown (HL).

This observation makes intuitive sense: news about SLA (a financial services firm) is likely to affect the views (and subsequently exposure and risk) towards other financial services firms. However, it’s curious that news contagion regarding SLA is unlikely to significantly affect investors’ views of HSBC or Legal & General (LGEN).

Whilst this is an illustrative example, understanding how news propagates through financial networks does have tangible benefits for corporates and fund managers. It provides insight into how news affects the views of investors and ultimately impacts the allocation of capital and risk in institutional portfolios.

Wang et al. also discuss another interesting idea, that of a “Control Mechanism”. Several academic, simulated models have shown different ways in which it might (theoretically) be possible to minimise or disrupt the spread of rumour and control the impact of news contagion. While research into control mechanisms have been largely motivated by the social, public health and political implications of rumour contagion (as we are seeing now with the Covid-19 coronavirus), they can be equally applied to understanding how news and views propagate and spread through company’s investor network and ripple through wider financial networks.

Over 16,000 listed corporates across North America, Europe and Australia are tracked and monitored daily by Irithmics’ AI which estimates how institutional investors are likely to adjust portfolio exposures and risks based on varying strategic, tactical and speculative views. While many views have similarities, the composition, ecosystem and evolution (or trajectory) of views is unique to each firm.

In the next few blog posts, we will take a more in-depth look into how deep learning is enhancing our understanding of how investors build and manage portfolios, and mitigate risks. We will use case studies to look at how insights from this technology benefit listed corporates, financial IR & PR advisors, asset managers and asset owners. On occasion we will also take a step back and review the current state-of-the-art in theories and models about how information spreads through human networks.

To learn about Irithmics Research or how our technology is helping corporates and asset managers understand the behaviour and dynamics of markets, just get in touch.

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.