The Social Side of Capital

Inferring Connections Between Portfolios

By Gavin Holt

Irithmics’ AI helps understand the significance of Ronaldo's gesture and subsequent market reaction towards Coca-Cola.

On Tuesday 15th June Portugal secured a convincing 3-0 win over Hungary in the European Championships. Portugal’s long time talisman Cristiano Ronaldo contributed two of those goals, overtaking France’s Michel Platini to become all-time top scorer in Men’s European Championship history. But as is so often the case in football these days, it’s what happened off the pitch that proved to be more significant - grabbing more headlines, and even impacting global financial markets in the process.

In the usual press conference following the game, Ronaldo took the opportunity to make a clear point and removed two Coca-Cola bottles strategically positioned in front of him. Caught on camera by the world’s press, the moment went viral almost immediately. One video from the Telegraph was viewed over 2 million times within 48 hours of the event. Coca-Cola is an official sponsor of the European Championships and this very public gesture from the health-conscious star was widely interpreted as a snub towards the multinational drinks corporation and its flagship product.

Coca-Cola's share price dropped from $56.10 to $55.22 almost immediately, representing a drop of 1.6% and reducing Coca-Cola’s market capitalisation by approximately $4 billion. Much mainstream and social media commentary has been devoted to the significance of Ronaldo’s gesture and the apparent market impact. Undoubtedly, Ronaldo is a global star and pop culture influencer with almost 300 million Instagram followers, but could his gesture alone be responsible for such a significant impact on Coca-Cola’s market capitalisation and the portfolios of the company’s investors.

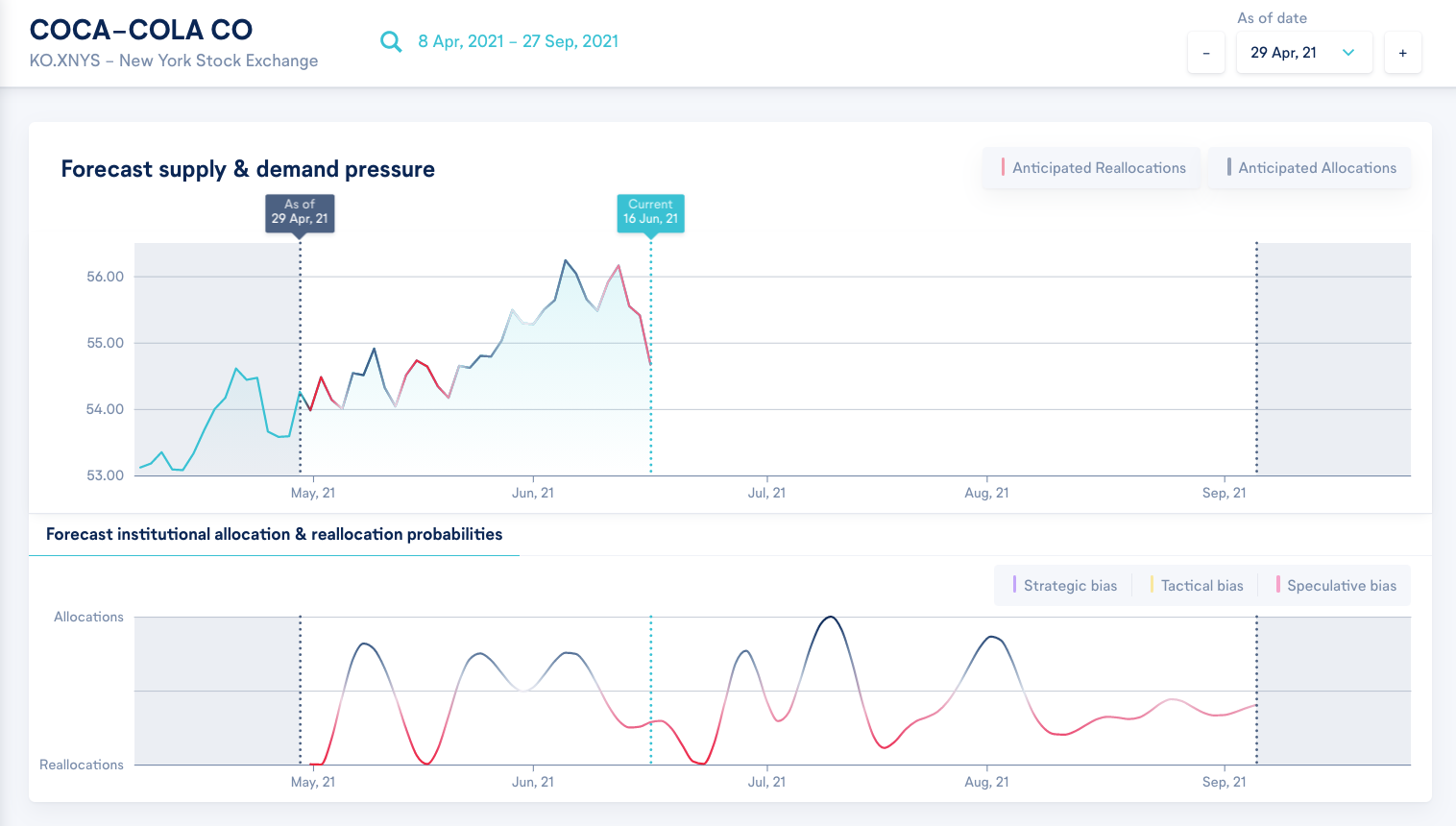

Forecasts generated by Irithmics' artificial intelligence 6 weeks earlier (on 29 April 2021) provide some helpful insight to market reactions. Irithmics’ AI recognises and classifies patterns in how institutional investors historically allocate and reallocate capital. Irithmics’ AI then uses these patterns to anticipate the implications for investors’ future allocations and reallocations. On 29 April, Irithmics’ deep neural networks had identified patterns in the behaviour of institutional capital which enabled the AI to anticipate the institutional reallocations were likely to occur on or around the 14th of June. Ronaldo’s gesture occurred on the 15th and, like his skills on the pitch, he might have provided a nudge to investors already primed to reallocate capital. See Figure 1.

Forecasted supply and demand pressure is one aspect of Irithmics’ AI assessment of the strategies, views and expectations of global institutional investors. These unique insights enable corporates, their senior management, investor relations and advisors to better adapt to investors and market dynamics.

For a more in-depth case study exploring disruption of investors’ views during the Credit Suisse/Archegos sell-off see: https://www.irithmics.com/blog/disrupting-investors-views/

And for more information on Irithmics’ Supply & Demand Pressure Forecasts, and how corporates, their advisors and asset managers benefit from these insights, see: https://www.irithmics.com/blog/decoding-impact-institutional-investors-market-supply-and-demand/

Schedule a demo or get in contact for more details.

Get the latest on products updates, research and articles.